Swap is the overnight fee on the Forex floor. It plays an important role, in helping traders understand the cost of raising orders and determining profitability. So is ICMarkets swap expensive or not? How to calculate this fee? If you still do not understand this term clearly, please refer to the article below from IC Trading!

Main Content

ToggleLearn about the term “ICMarkets swap”

Let’s learn and dig deeper into what terminology in Forex is.

What is Swap in Forex?

Swaps in Forex are also known as overnight fees. This is the amount of money that traders will receive or pay after each night of holding an order. At the same time, a swap also represents the difference in interest rates of two different currencies.

For Swing traders, overnight fees are really important to them. Because this is a factor that makes it easier for them to estimate the cost of holding a position overnight. From there, it is possible to come up with more reasonable and effective investment plans.

However, on the contrary, if you are a Scalping or Day Trading trader. When orders are completed in a short time or within a day. Then overnight fees don’t matter to you.

What is understood by ICMarkets swap?

Swap ICMarkets is simply understood as the overnight fee of ICMarkets. It is not simply a transaction cost. In addition, it also specifically reflects changes in interest rates in economies. That’s why investors can grasp risks and expand opportunities for trading on the foreign exchange floor.

Is the IC Markets Forex floor free of IC Markets swap fees?

One of the questions that receives the most attention comes from investors. That is: “Is ICMarkets Forex floor free or not?”.

ICMarkets does not provide overnight fee-free services for regular accounts. So when participating in trading and holding overnight positions on the MT4 or MT5 platforms. Investors need to pay a flexible fee.

However, the ICMarkets swap-free service applies to Islamic objects and accounts. These are special traders who enjoy preferential treatment from ICMarkets due to their religious nature. That’s why investors in this system do not need to worry much when holding orders overnight.

>>>See more: ICMarkets register on your phone is the fastest

What do traders need to know about ICMarkets swap fees?

If you are a genuine trader, here is all the information you need to know about this type of fee.

Is swapping ICMarkets expensive?

ICMarkets swap is divided into 2 different dimensions. One way is to buy by BUY order and the other is to sell by SELL order. As mentioned above, a swap can be an amount of money that a trader can receive or pay when holding a position overnight. Furthermore, it also depends on the interest rate difference between currencies. Therefore, the ICMarkets swap fee is not fixed and cannot be determined whether it is expensive or not.

How to calculate overnight costs on ICMarkets

If you still don’t know how to calculate the overnight fee on ICMarkets. Then please try to refer to the information below.

Swap calculation formula

The swap calculation formula is also based on many different factors, such as Interest rate difference, and trading lot volume… Specifically as follows:

| Swap ICMarkets = Overnight fee x Lot size x 0.0001 pip x number of days the position is held |

In there:

- Overnight fee: Fee for swapping buy or sell orders

- Lot size: Standard is 100,000 currency units

An illustrative example of an ICMarkets swap

To help readers easily understand and apply the above formula. IC Trading will provide a few specific illustrative examples as follows:

For example, you are holding a buy order swap position of 0.02 within 2 days for the EUR/USD currency pair. Then the overnight fee will be calculated as follows:

| Overnight fee = 0.02 x 100,000 x 0.0001 x 2 = 0.4 USD |

That means you will have to pay 0.4 USD for holding the EUR.USD currency pair position for 2 days.

How to minimize swap costs

Of course, if you are a trader following the Swing campaign. How to minimize ICMarkets swap costs is always a difficult problem for you. However, now you will no longer have to worry too much with our support. To minimize costs most effectively, apply some of the tips below.

- Refer to currency pairs with low interest rate differences such as EUR/USD or USD/JPY… to minimize costs.

- You should not open positions at sensitive times such as: There are outstanding economic events or large market fluctuations… Because those issues will cause risks and increase swap fees.

- Limit holding positions overnight, instead do short-term trading or close orders at the time the market closes in the last trading sessions.

- Use tools like Stop-Loss or Take-Profit to close orders automatically when the set limit is reached. That helps you minimize certain risks.

>>>See more: ICMarkets: A leading trading platform for the financial markets

Information to note about Swap ICMarkets

In addition, to be able to use ICMarkets swap effectively and with the least risk. Dear readers, please try to note the important information below.

-

- ICMarkets swap only applies when you hold the position until the next trading day.

- On Wednesday nights, swap rates for trading products such as Forex, bonds, commodities, and metals. All will be applied at a fee 3 times higher than normal.

- On Friday night, Energy products, cryptocurrencies, and indices will be charged at 3 times the normal fee.

- Lot sizes will be measured to the standard of 100,000 base units.

- Overnight Swap rates can be positive or negative.

- ICMarkets swap is calculated in points. From there, the MT4 and MT5 platforms will automatically apply and translate into base currencies in the account.

ICMarkets with attractive swap fees is attracting many traders around the world. If you want your trading to not have to worry about internet problems or power outages, you can use ICMarkets VPS service.

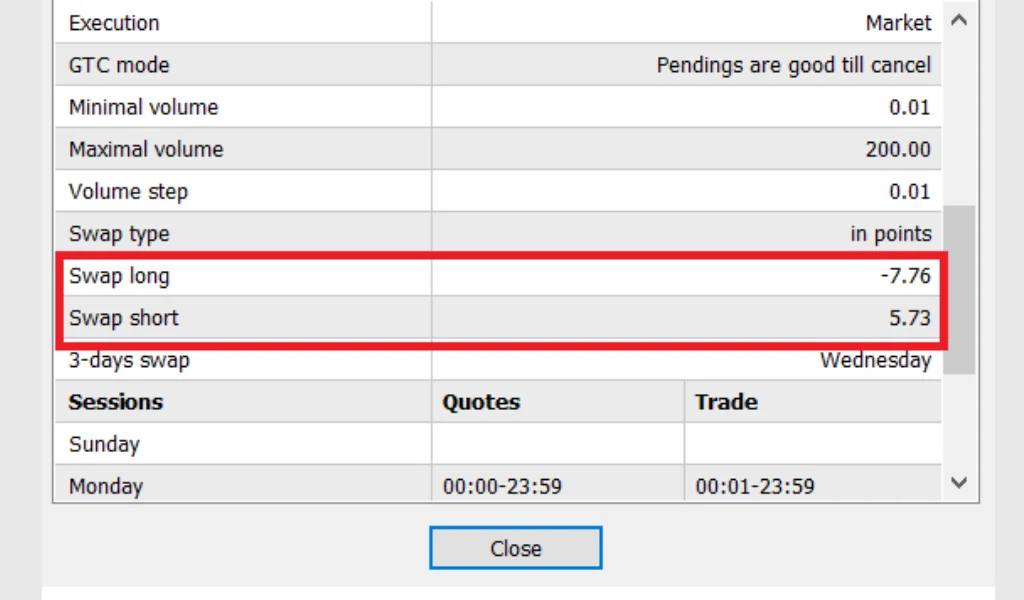

Instructions on how to view ICMarkets swap fee on ICMarkets

Currently, with the continuous improvement and modern development of IC Market’s foreign exchange platform. Consumers can easily view overnight fees without having to apply a manual calculation formula. Below is the 4-step process, making it easiest for you to see.

- Step 1: Log in to your ICMarkets account on the MT4 platform

- Step 2: Right-click on the currency pair to view the overnight fee in the “Market Watch” window.

- Step 3: Select “Specification” to see detailed parameters on the screen.

- Step 4: See the corresponding values for Swap long and Swap short in the “Swap” section.

In addition to attractive Swap rates, ICMarkets also supports many different deposit methods such as visa card, bank account, ICMarkets paypal deposit … What are you waiting for without participating in trading with us?

Summary:

With the information that IC Trading has given in the above article. We are sure that our readers can better understand the term ICMarkets swap. As well as the fastest way to see overnight fees at ICMarkets.

FAQs:

Does ICMarkets provide overnight free service?

ICMarkets only provides Muslim account users.

Is the ICMarkets swap fee expensive or cheap?

The overnight fee at ICMarkets depends on many factors such as: Currency interest rate differences or order holding time…

Which currency pair has the highest swap fees?

At ICMarkets, the currency pairs with the highest swap fees include AUD/USD, USD/ MXN, USD/ZAR, USD/ TRY, NZD/USD…