Spread is a type of fee familiar to investors when participating in transactions. So what specifically is ICMarkets Spread? How is it calculated? What factors affect spread? To better understand this type of fee, please refer to IC Trading shares in the article below.

Main Content

ToggleICMarkets spread explained

Investors can simply understand that spread is the difference between the buying price and selling price of a financial instrument at present. This is also the main income of foreign exchange brokers.

Based on spreads, brokers, including ICMarkets, make money. Instead of charging separate fees for each transaction, the exchange will calculate all costs through spreads.

For example: When receiving a market quote with a spread of 1 pip. The brokerage will notify investors of an increase of 0.1 pip each way. At that time, the spread increased to 1.2 spread.

Thus, every time you buy or sell that currency pair, the broker will earn a commission difference of 0.1 pip. Therefore, if a platform advertises that they do not charge commission fees. The commission is calculated directly into the spread.

Things to pay attention to about ICMarkets Spread levels

If you choose to participate in trading on ICMarkets. In addition to the ICMarkets Paypal Deposit deposit method, you should not ignore the regulations and calculation of ICMarkets spread that the floor stipulates. Basic information that investors need to understand before participating in trading.

What is the minimum ICMarkets spread?

Currently, the exchange is offering spreads as low as 0.0 pip. This fee will apply to Raw Spread accounts (MT4, MT5) and Raw Spread accounts (cTrader). This means that in some cases you will not have to pay the difference when participating in the transaction.

Is ICMarkets spread high or not?

In general, ICMarkets spreads offer very low spreads. From only 0.6 pips for standard account type – Standard. For the remaining two account types, the spread will be from 0.0 pip.

However, depending on the type of product you choose to trade, there will be different spreads.

How is ICMarkets gold spread calculated?

For ICMarkets Spread, you just need to remember the following formula:

SPREAD = ASK PRICE – BID PRICE

In there:

- Ask price: This is the price at which the brokerage company is willing to sell the base currency in exchange for the quoted currency at the best price.

- The Bid price is the bid price or the price at which the brokerage company is willing to buy the weak currency. This will be the price at which investors can sell to the market.

In this case, you want to calculate the spread of Gold (XAU). Suppose, the Gold pair calculated at the exchange rate with USD (XAU/USD) has a bid price is 1729.43 and an ask price is 1729.83, with a difference of 40 units.

Note that 40 units here are 40 pipettes = 4 pips. Thus, the gold spread is 4 pips.

Analyze factors affecting ICMarkets spread

Spreads are constantly changing due to the influence of many different factors. Specifically:

Currency exchange rate fluctuations when trading on ICMarkets

Currency exchange rate fluctuations will be handled and implemented by each country’s central banks based on monetary policy. When the policy is implemented strictly and stably, it will help prevent exchange rates from fluctuating too much in the market.

When there is a policy change, it will lead to a change in the exchange rate margin. From there, the Ask and Bid prices change.

Geopolitical situation of the host country

Any economic changes such as reduced interest rates, inflation,… affecting each country’s currency will affect ICMarkets spread. When a currency decreases, the exchange rate compared to a strong currency will increase. From there, liquidity decreased, creating a large difference between Ask and Bid prices. This is also the cause of increased spread.

Market liquidity

Liquidity is also known as trading volume. At that time, high trading volume will cause buying and selling prices to fluctuate widely. At that time, the Bid and Ask prices did not have much difference, attracting more transactions.

High spreads are often found in major currency pairs. For example: USD/GBP, USD/EUR,… Besides, there will be currency pairs with low liquidity, leading to high spread fees. For example: Currency pairs USD/ZAR, USD/MXN,…

>>>See more: Instruct with an ICMarkets open account swiftly

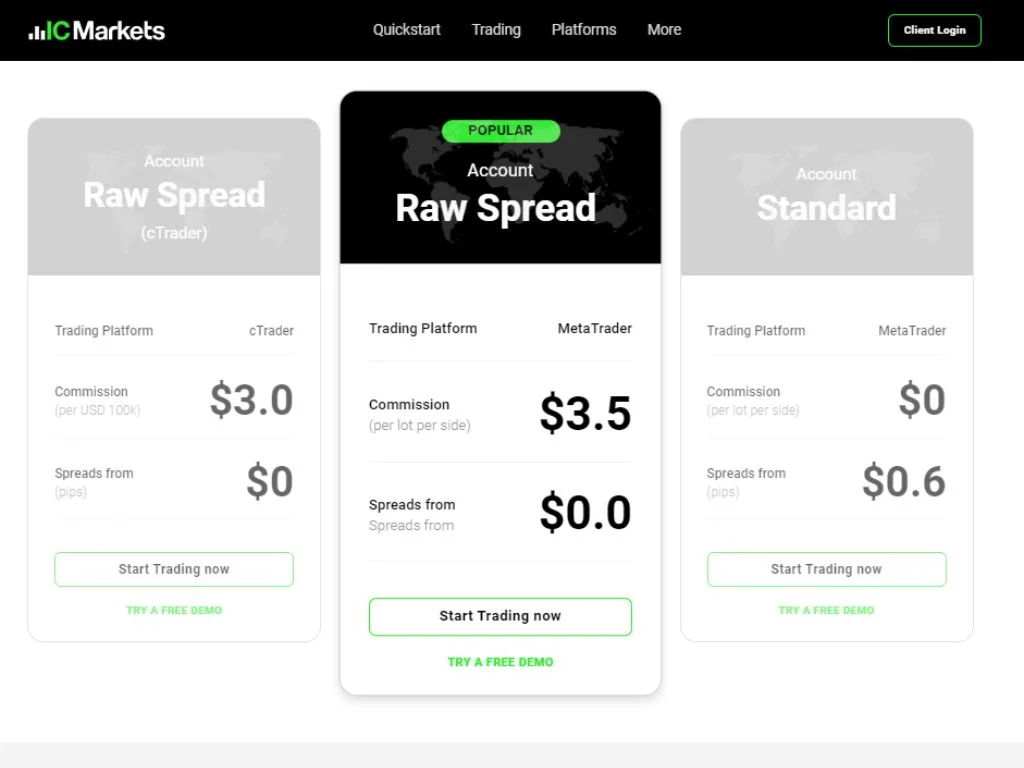

ICMarkets account types have low spreads

As shared above, ICMarkets Spread will change depending on the type of account you register. As follows:

Raw Spread account with optimal spreads

This account is considered the most popular at ICMarkets. What is of most concern is the super low spread. On average, the broker only needs 0.1 pip for the EUR/USD currency pair.

Additionally, the Raw Spread account has competitive commission fees. Only about $3.5 per lot per side. Besides, there is also the advantage of fast order matching, with almost no latency.

At the same time, it is very rare for orders to be requoted on the Raw Spread Account

However, this account also has small disadvantages. When there is strong news or the opening and closing of trading sessions between days, Spreads are likely to widen.

Raw Spread Account (cTrader)

For this type of account, there will be low Spread and Commission fees. Therefore, it is very suitable for scalping or intraday investors.

cTrader accounts are not significantly different from other accounts. The only difference is that it is traded on the Ctrader platform. The outstanding advantage is the beautiful, investor-friendly interface.

Conclude

Thus, the article has compiled all information related to ICMarkets spread. Hopefully, sharing the calculation and spread of each account type at ICMarkets will help investors better understand this fee. If you want to learn more information about other fees, the ICMarkets IB program … and many other interesting content, don’t miss the next articles on IC Trading.

>>>See more: ICMarkets: A leading trading platform for the financial markets

Frequently asked questions

Below are a few frequently asked questions related to spreads on ICMarkets. Investors can refer to this information to better understand this type of difference fee.

In addition to spread fees, does IC Markets collect any additional fees?

The answer is yes. Besides the spread, the trading floor will charge an additional commission fee for the Raw Spread account. In case you hold an order overnight, you will have to pay an additional fee to hold the order.

When does the spread reach 0?

Spread is the difference between Bid and Ask prices. Therefore, the spread reaches 0 when the number of buyers and sellers meet at the same price. However, zero spread is always a temporary situation and cannot last long.

In financial transactions, what is Spread?

At this time, spread is still considered the distance between the buying price and selling price of a certain financial asset. ICMarkets Spread is a fee that investors must pay when they want to open a trading position. The way to calculate the difference is to apply the formula of taking the selling price minus the buying price.

Depending on the time, the spread fee will change and have different differences. This also depends on other factors that affect the price.